How to Use the 70% Rule in House Flipping

In 2005, during the height of the housing market, house flipping was hot. With fluctuations in the market, it slowed. But now 8.2% of all homes sold are a house flip.

House flipping is the idea of buying a house, doing repairs and renovations, and then hopefully reselling it for a profit. To achieve the money-making goal, house flippers must be scrupulous about what they pay for a house and how much they spend on a variety of renovations.

Those renovations can include everything from cleaning and removing trash to knocking down walls and changing the footprint of the home’s interior.

One method used by many house flippers to work towards that end profit is to use something called the 70% rule. This is a mathematical equation used to guide the buying of properties that could potentially be flipped.

To learn more about house flipping and the 70% rule, read on.

What Is the 70% Rule?

The goal for a house flipper is to buy a house that they can sell quickly for a profit. To do this, the goal is always to buy a house at a low price.

Do as many renovations and repairs as they can themselves, then sell it for a nice profit.

Many flippers follow the 70% rule to help them decide if they should go ahead and purchase a property. It gives them a pretty good gauge about whether they’ll actually make the desired profit or not.

It’s important for flippers to know and understand the market they’re buying in to know how closely they need to follow the rule. They also need to have a tight handle on their costs and know-how to appraise well.

How Does the Rule for a House Flip Work?

So, how does the rule work exactly? The rule helps a flipper identify the maximum amount they should pay for a property when they hope to flip and make a worthy profit.

First, you don’t really pay attention at first to the asking price. The flipper will study a house and consider what kinds of repairs and renovations are necessary and what those costs will be.

The flipper needs to start with the after-repair value or ARV. More on this term shortly. They multiply the ARV by 70% or .70. They take this number and subtract their estimated total costs for investing and repairing the house.

That end number should tell the flipper the maximum they should pay for the house they hope to flip.

What Is the After Repair Value?

One of the most important parts of the 70% rule is the after-repair value. This isn’t an easy number to come by and is key to the formula’s success.

A house flipper needs to be keenly aware of the market they are buying in. What are houses selling for in the area? Is it a hot market or a stagnant one?

Part of getting to the after-repair value number is knowing what’s important to homebuyers and to have an understanding of what they’ll be willing to pay for it.

They need to be either very good home appraisers or work closely with one who knows the area well as they work out the after-repair value number.

Is the Rule an Accurate Measure for Money Making?

Is the 70% rule accurate? it can be. It can also be not so accurate depending on the market the home is in.

The goal of the 70% rule is to keep a house flipper from spending too much on a property. If you spend too much when you buy it, it can greatly impact your profit.

The problem arises when you consider what might be happening in the housing market for where the flipper hopes to buy.

If the market is sluggish in an area or there are many homes for sale, the flipper may have better luck getting the house for a low enough price to follow the 70% rule.

Many housing markets across the US are hot. Houses are selling fast and for escalated prices. This doesn’t work in the favor of the house flipper.

What If the Offer Following the 70% Rule Gets Rejected?

A rejected offer is a real possibility for some housing markets. If houses are selling quickly and there is low inventory, a home seller might decide they won’t settle for the lower offer the flipper gives.

This is the reality of a busier housing market.

The house flipper then needs to reevaluate. If the housing market in the area is hot, did they put the correct number value of the after-repair value calculation?

It’s possible a repaired and renovated house might be worth more than anticipated. It’s risky to assume this though.

The flipper may have to adjust the 70% number to get to a number that would be accepted by home sellers.

Of course, if they raise their 70% number, this impacts profits and they need to calculate if it’s worth the investment.

A House Flipping Guide: What Might a Flipper Do in a House?

Of course, another important part of all the calculations involves the repairs and renovations needed in the house.

Some house flippers are very skilled in a variety of home repairs and do most or all of the work. They aren’t paying for outside labor which can help.

Other flippers subcontract out the work hoping to get it done more quickly than they could do it by themselves.

Many house flippers start with a house in a serious state of disrepair. It’s often how they’re able to purchase them for such a low price.

But renovations often go beyond cleaning and new paint. A house flipper should be aware of what buyers want.

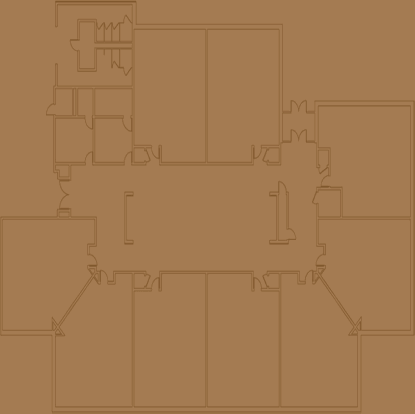

For example, when buying an older home, a flipper may start with a series of small tiny rooms. Homebuyers now crave an open concept with large open rooms that feel like one big space.

This might mean the flipper is making the decision to take down walls and open up the house to achieve this goal. While this might be a more costly renovation, it’s also likely to be one worth it in the after-repair value number.

Include All Costs When Calculating

Costs are also an important part of the calculations. A successful house flipper needs to have firm control of their costs to achieve the right profit margin.

Costs come in a variety of forms for the house flipper, including:

- List of all costs for materials

- Maintenance needs

- Taxes

- Insurance payments

- Real estate agent’s fees

- Closing costs

- Title insurance

In the current economy, material costs are high because of supply chain issues and demand. A house flipper doing calculations for the 70% rule would need to know those costs well.

Use the Conservative Numbers Benchmark

Another way to ensure the right profit for a house flipper is to follow the conservative numbers guide. This means you approach all calculations using the 70% rule and treat them as the worst-case scenario.

If you’ve ever done any home renovations, you should well know that they can be full of surprises and unexpected expenses.

For the house flipper here, they should plan for the worst-case scenario. You might hope the after-repair value could tip-toe up to $400,000. But it might be realistic to plan for $375,000.

Likewise, if purchasing many materials for renovation is necessary, plan for the highest amount you can imagine.

Then if your estimates are off, you still have the chance for a decent profit margin.

70% Rule Scenario

Let’s walk through a possible scenario using the 70% rule to see how a house flipper might make a decision.

Imagine the predicted after-repair value of a house will be $350,000. The house flipper would multiply that number by .70 to get to $245,000.

The next step is evaluating the house and considering what needs to be done. Then calculate how much it will be for costs for repairs, taxes, insurance, real estate fees, and any other ancillary expenses.

Let’s say that number is $70,000. So, the flipper would take $245,000 and subtract the $70,000 to get $175,000.

Using the 70% percent rule, the most a flipper should pay for this property is $175,000.

Rule or Guide?

The 70% rule for house flippers came about for a reason. It seems to be a successful benchmark for whether an investment is worth it or not.

But it’s also not a hard rule that all house flippers follow. Some do the calculations using the 70% rule and use it as more of a guide as they consider the reality of their current housing market.

An experienced flipper will know when it’s likely to waiver from the rule and perhaps buy the house for a little more than that final number.

House Flipping Using the 70% Rule

For some, house flipping proved to be a lucrative business model. The real estate market was right and flippers could buy low, renovate and still sell higher.

As a house flipper, you might be interested in doing the kind of renovations that we do. We could help you transform a home into something profit worthy by taking down walls and opening up a space. Learn more about our work and contact us to get more information.